ev tax credit 2022 status

There is a federal tax credit of up to 7500 available for most electric cars in 2022. For deliveries this year one would have to have a tax liability of.

Transforming Personal Mobility Alliance For Automotive Innovation

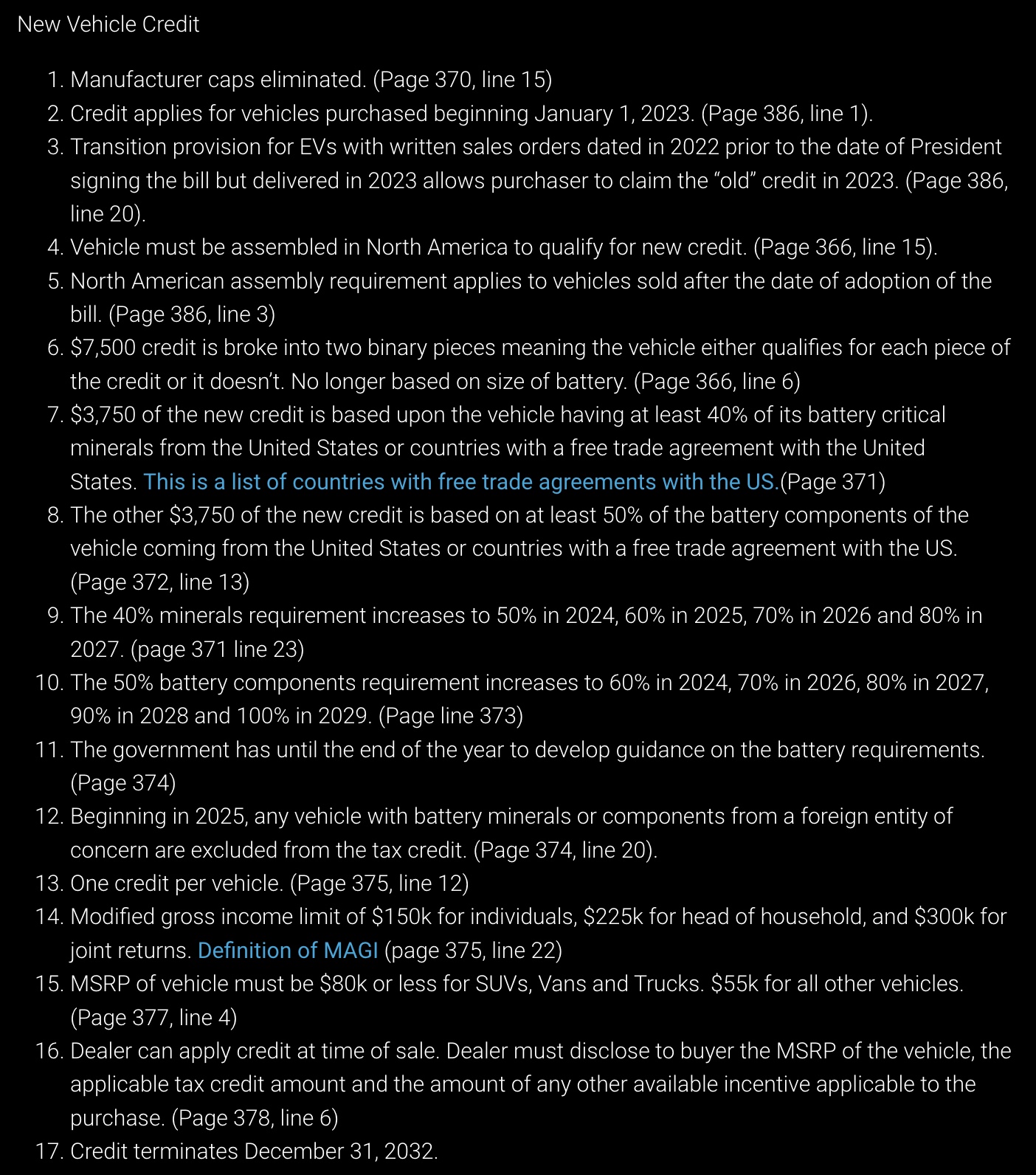

The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the.

. Colorado EV Tax Credits. Knowing how much you can save over the ownership experience you might be wondering why you havent considered an EV6 already. Federal tax credit for EVs maintained at 7500.

421 rows If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16 2022 but do not take possession of the vehicle until on or after. That price threshold rises to 80000 for new. The incentives had been proposed to go as.

Theres now an income cap of 150000 for the modified adjusted gross income of individuals 225000 for heads of households and 300000 for joint tax filers. Back in May FoMoCo CEO Jim Farley stated that he expected Ford EV tax credits of 7500 to dry up by late 2022 or early 2023. Many EVs these days have a 100 kWh.

Lets run the calculation for clarity. Price matters but not until January 1. Qualifying EVs purchased before August 17 2022 are eligible for a tax credit that is available for the purchase of a new qualified EV that draws propulsion using a traction battery.

You can buy the 2022 Kia EV6 for a starting MSRP of 40900. The Inflation Reduction Act the major climate. The bill would allow car buyers to continue to claim the current 7500 federal tax credit for the purchase of clean vehicles the new preferred phrase describing plug-in hybrid.

Eliminates tax credit cap after automakers hit 200000 EVs sold making GM and Tesla once again eligible. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

Electric sedans priced up to 55000 MSRP qualify. The US Federal tax credit is up to 7500 for an buying. If you buy a car now in August 2022 you cannot claim the 7500 credit until you file your taxes in 2023.

If you buy or convert a light-duty EV in Colorado you may be eligible for a 2500 tax credit 1500 for leasing in 2022. Latest EV Tax Credit Status. Here are the cars eligible for the 7500 EV tax credit in the Inflation Reduction Act.

A new federal tax credit of 4000 for used EVs. Subtract from that amount the federal tax credit and any qualifying state credits and you have yourself a pretty good value proposition. Page 389 line 7.

Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022. At that point Ford would join number of other. Its the latest bit of bad EV news to hit Toyota.

New battery electric cars that cost more than 55000 do not qualify for the EV tax credit. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23. Ford is most likely to quickly follow.

There are no income requirements for EV tax credits currently but. Latest on Tesla EV Tax Credit. 16th 2022 611 pm PT.

Income rules for 2022 vs. In other words you still pay the 7500 now at the time of purchase but will. Used vehicle must be at least two model years old at time of sale.

Zero-emission vans SUVs and trucks with MSRPs up to 80000 qualify. There are some things they could do like preferentially send cars outside the US for the last few months of 2021.

What To Know About The Complicated Tax Credit For Electric Cars Npr

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

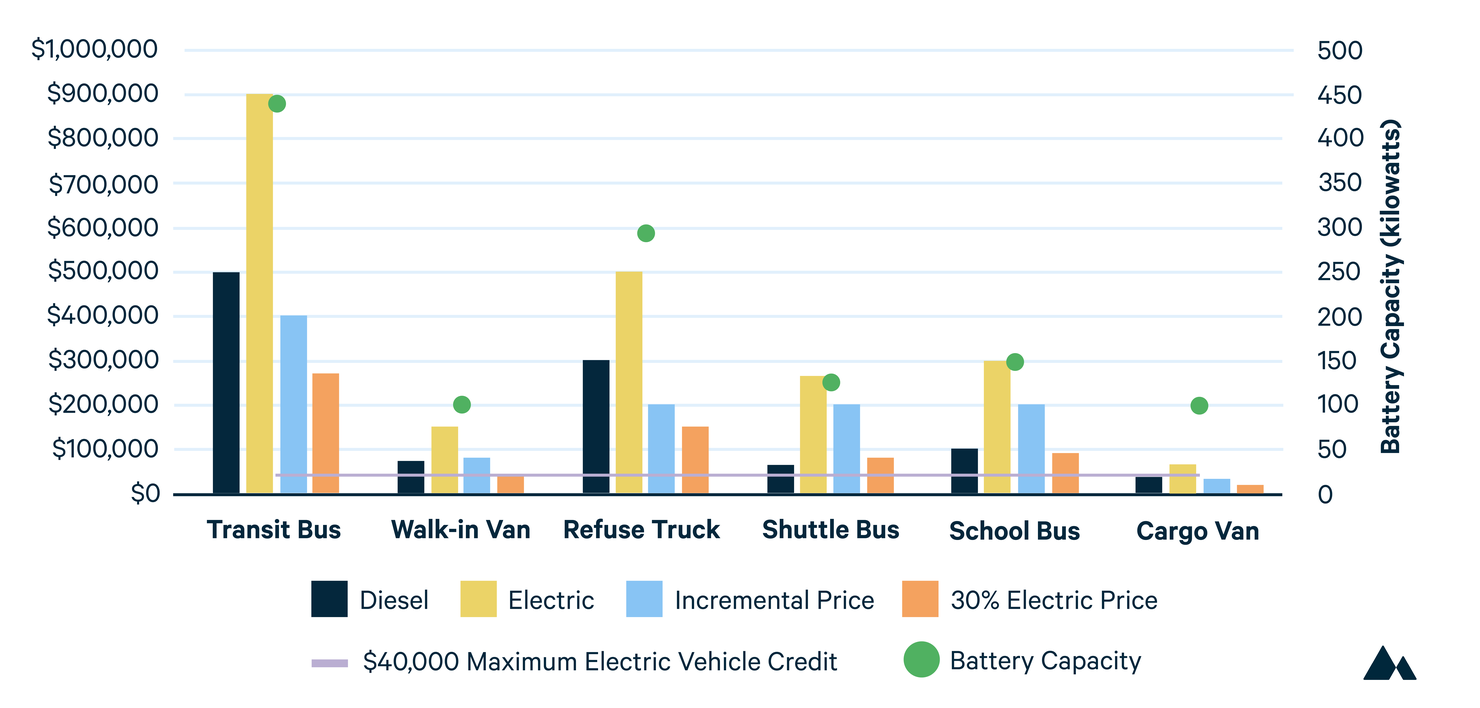

Inflation Reduction Act Examining Electric Vehicle Subsidies For Medium And Heavy Duty Vehicles

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Ceos Of Gm Ford And Others Urge Congress To Lift Ev Tax Credit Cap

How Does The Federal Tax Credit For Electric Cars Work

These 5 Plugin Vehicle Models Would Benefit Most From Proposed Us Ev Tax Credit Update Chart Cleantechnica

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Irs Issues Immediate Guidance For Ev Credits Under Inflation Reduction Act Accounting Today

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Fred Lambert On Twitter Here S A More Detailed Look At The Ev Tax Credit Reform That The Senate Is Expected To Make Happen Thanks To Chris Stidham Https T Co Yhwk7mn4cv Https T Co T6rbzuwuhn Twitter

New Electric Vehicle Tax Credits Raise Talk Of Trade War The San Diego Union Tribune

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Api Study Electric Vehicle Tax Credit Is High Cost Low Reward

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters