nebraska sales tax percentage

Ainsworth 15 70 07 52-003 00415 albion 15 70 07 81-004 00555 alliance 15 70 07 27-008 00905 alma 20 75 075 82-009 00975 ansley 10 65 065 234-015 01535 arapahoe 15 70 07 157-016 01780 arcadia 10 65 065 192-017 01850 arlington 15 70 07 206-018 01990 arnold 10. ArcGIS Web Application - Nebraska.

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Lev Business Tax Income Tax Cost Of Goods Sold

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75.

. The Lincoln sales tax rate is. According to the Nebraska Department of Revenue the Nebraska state sales tax rate is 5. Businesses are responsible for paying property taxes on any business-owned property including buildings machinery equipment inventory and land.

The average effective property tax rate in Nebraska is 1. Nebraska State Tax Rates information registration support. If the seller is not licensed to collect Nebraska sales tax or fails to collect the sales tax then the customer becomes personally liable for the tax and must pay it.

Nebraska Department of Revenue. 30 rows Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

The Nebraska state sales and use tax rate is 55. Look up 2022 sales tax rates for Max Nebraska and surrounding areas. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05.

Tax rates are provided by Avalara and updated monthly. The use tax rate is the same as the sales tax rate. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The Nebraska state sales and use tax rate is 55 055. The Nebraska state sales and use tax rate is 55 055. Find your Nebraska combined state and local tax rate.

Did South Dakota v. The Nebraska sales tax rate is currently. Additionally city and county governments can impose local sales and use tax rates of up to 2 percent.

Social Security and military pensions are not exempt from taxation in Nebraska and real estate is charged at its full market value. This is the total of state county and city sales tax rates. The current state sales tax rate in Nebraska NE is 55 percent.

Nebraska also has special taxes for certain industries that may be on top of. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top. Nebraska Sales Tax Rate Finder.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Nebraska has a state sales tax of 55 percent for retail sales. The Total Rate column has an for those municipalities.

What is the current sales tax in Nebraska. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. Groceries are exempt from the Nebraska sales tax.

Wayfair Inc affect Nebraska. The County sales tax rate is. Did South Dakota v.

The County sales tax rate is. 536 rows 6325 Nebraska has state sales tax of 55 and allows local governments to. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The cumulative Nebraska sales tax percentage is between 5 and 7 percent due to the addition of one or more municipal sales taxes and one or more special district taxes ranging from 0 to 2 percent. The total tax rate might be as high as 75 percent depending on individual municipalities however food and prescription prescriptions are exempt. Nebraska levies a property tax on all real and personal property within the state.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The base state sales tax rate in Nebraska is 55. Integrate Vertex seamlessly to the systems you already use.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Nebraska sales tax rate is currently. Ad New State Sales Tax Registration. Wayfair Inc affect Nebraska.

With local taxes the total sales tax rate is between 5500 and 8000. Nebraska has recent rate changes Thu Jul 01 2021. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

What is the sales tax rate in Lincoln Nebraska. Has impacted many state nexus laws and sales tax collection requirements. The Omaha sales tax rate is.

Select the Nebraska city from the list of popular cities below to see its current sales tax rate. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. The 2018 United States Supreme Court decision in South Dakota v.

Tax Rate Starting Price Price Increment Nebraska Sales Tax Table at 55 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 006 120 007 140 008 160 009.

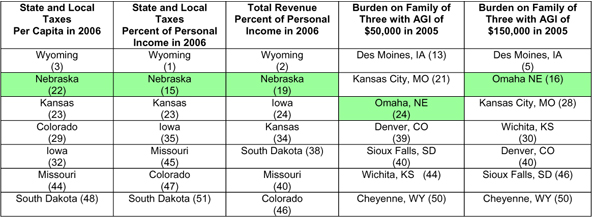

Taxes And Spending In Nebraska

Nathan Madden On Twitter Healthy Kids Grocery Kansas

State Corporate Income Tax Rates And Brackets Tax Foundation

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

This Map Shows How Taxes Differ By State Healthcare Costs Better Healthcare Federal Income Tax

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Should You Be Charging Sales Tax On Your Online Store

Sales Tax On Grocery Items Taxjar

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

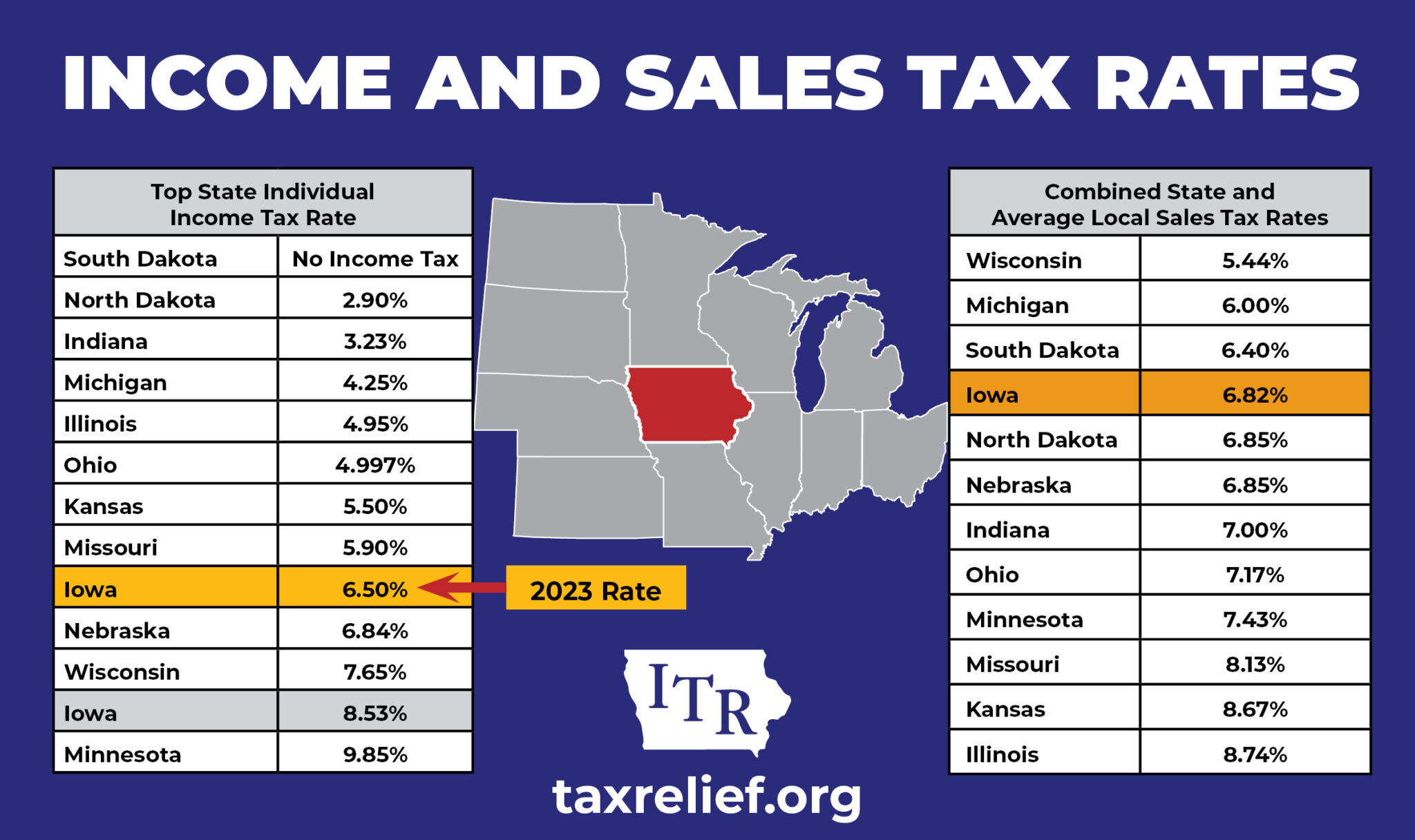

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Marketplace 1997 Nebraska Championship Poster Nebraska Nebraska Cornhuskers Husker Football

Florida Property Taxes Rank 27th Nationally States In America Property Tax Estate Tax